Description

The best, and least costly, mortgage insurance a consumer can have is to maintain, preserve, and safeguard a complete Mortgage File in two parts:

- PART I: keep a permanent archive of the mortgage loan documents you supplied to and received from the lender during the loan origination process (i.e., the Closing File); and

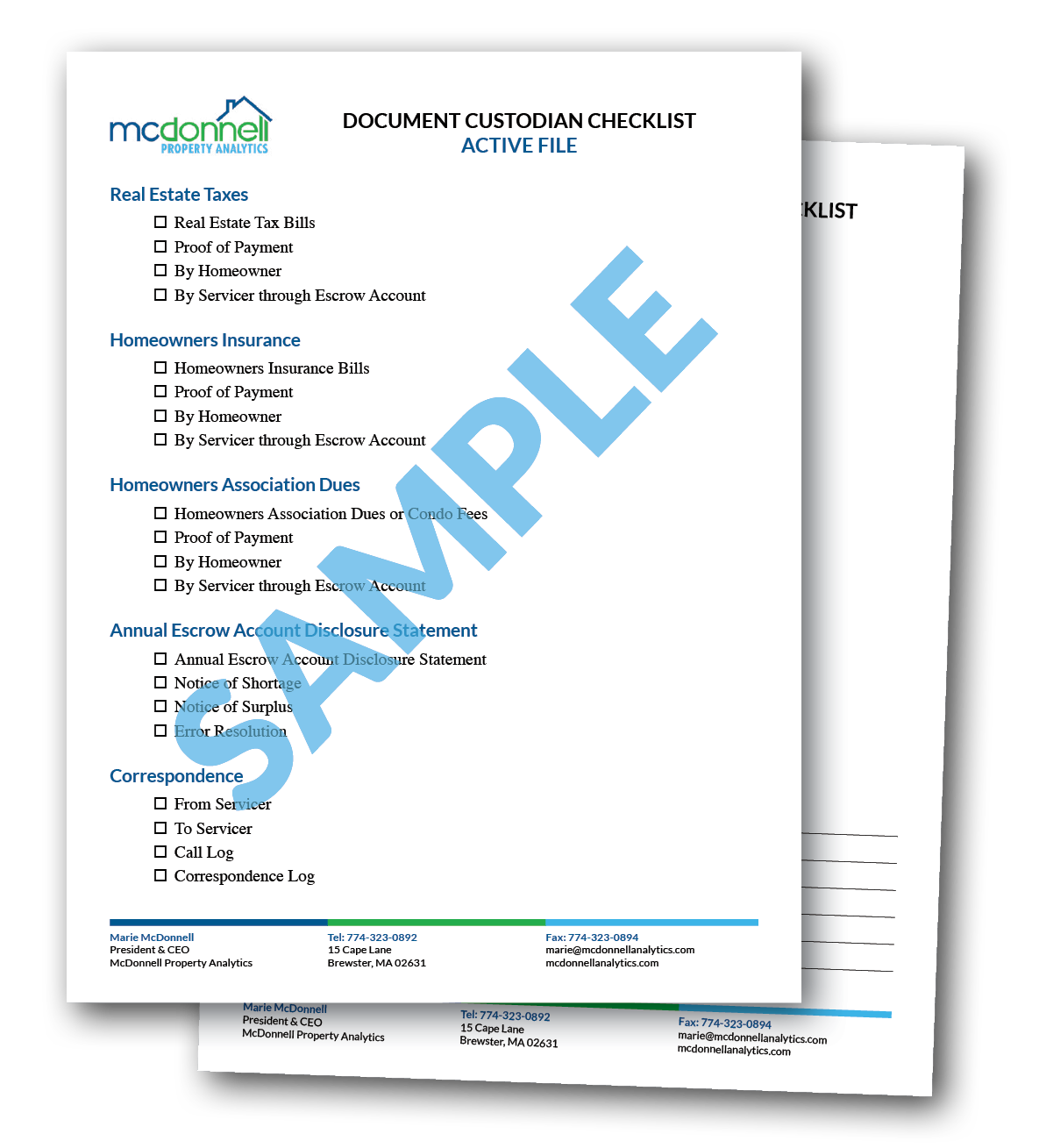

- PART II: set up an annual file containing your monthly mortgage statements, real estate tax bills, homeowners’ insurance premiums, year-end 1098 mortgage interest statement, annual escrow account disclosure statement, correspondence, etc. (i.e., the Active File).

The following checklists will help you to organize your important documents which you should retain until, at least, one year after you have paid off your mortgage loan.

- Document Custodian Checklist — Closing File

- Document Custodian Checklist — Active File

(Both Checklists are included for $15.00)

Remember, Your Mortgage File is Evidence at Trial!